By Bill Taylor, Contributor/Fintek Capital We compare the price of Bitcoin, Ethereum, & Gold, using the CME Bitcoin Indexes (BRR & BRTI) and the CME Ethereum Indexes (ETH_RR_USD) & (ETH_RTI_USD) for reference. 6/27/19 Closing Prices:Bitcoin: $11,652.16 (-$1,195.57) Ether: $305.50 (-$39.89) Gold: $1,408 (-$3.50)) DJIA: 26,526.58 (-10.24) S&P 500: 2,924.92 (+11.14) Nasdaq Comp: 7,967.76 (+57.79)Trading Summary Notes for Thursday, 6/27/2019

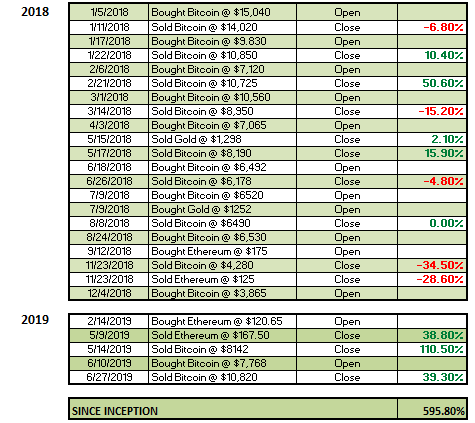

- SOLD BITCOIN @ $10,820 ON 6/27

- BITCOIN drops over $3,000 in a day. Short squeeze over? End of quarter profit taking? Facebook Libra enthusiasm done?

- Could be all of the above. Big run-up before end of quarter and then investors sell to lock in their gains.

- BITCOIN volatility is back and with summer in full swing the liquidity is reduced……meaning bigger swings

- What now????? Still think this is a very powerful new upside move, but too far to fast. Let’s see where BTC is the first few days of July (the new quarter). $9,000-$9,500 might look “interesting” for a run up to $15,000

- ETH works so hard to go up, but goes down really easy. Just saying.

- Not a big fan of ETH. Back to $250-$275?

- GOLD has lots of new life. Upside intact

- Expect a brief period of time to “zig and zag” above the $1,400 round number before resuming rally. That’s what you call “backing and filling” or basing.

- Like to odds of seeing $1,650-$1,700 for GOLD

Current trading positions: LONG GOLD

Bill Taylor is Managing Partner at Fintek Capital & a frequent contributor to FintekNews