By Bill Taylor, Contributor/Fintek Capital We compare the price of Bitcoin, Ethereum, & Gold, using the CME Bitcoin Indexes (BRR & BRTI) and the CME Ethereum Indexes (ETH_RR_USD) & (ETH_RTI_USD) for reference. 4/11/19 Closing Prices:Bitcoin: $5,037.74 (-$230.30) Ether: $163.77 (-$16.66) Gold: $1,292 (-$17.00) DJIA: 26,143.05 (-14.11) S&P 500: 2,888.32 (+0.11) Nasdaq Comp: 7,947.36 (-16.89) Trading Summary Notes for Thursday, 4/11/2019

- After the strong run up recently, BITCOIN and ETH succumbed to some profit taking today. Nothing goes straight up and this was a slight pullback

- BTC and ETH (most cryptos) have turned and if anyone missed the rally (unless you follow us) getting a dip to buy is a great opportunity

- How about this; buy BTC and ETH with a sell stop 10% lower. Risk 10% to possibly make…….a lot more

- With our next near term target for BTC at $6,500 expect ETH to see $190-$195

- GOLD hit some big selling (profit taking……again) as the UK got a reprieve to finalize a Brexit deal till Oct 31. Kick that can further down the road

- The near term reprieve alleviates some fear of a hard exit, meaning GOLD profit taking

- GOLD dips are a buying opportunity and support around $1,285-$1,290. Upside target still $1,400

- Again, to sum up, near term targets; BITCOIN $6,500 ETH $190-195 GOLD $1,400

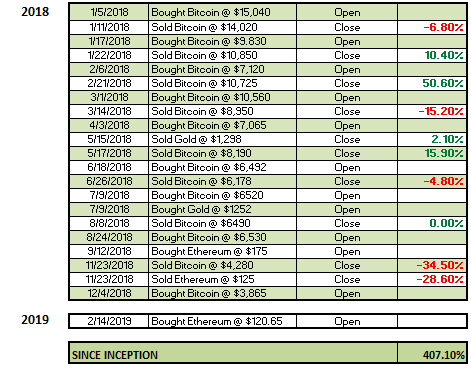

Current trading positions; LONG BITCOIN, ETH AND GOLD

Bill Taylor is Managing Partner at Fintek Capital & a frequent contributor