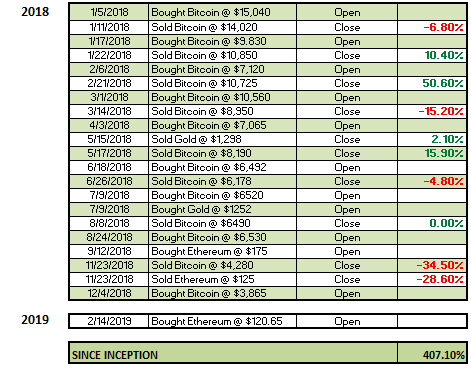

By Bill Taylor, Contributor/Fintek Capital We compare the price of Bitcoin, Ethereum, & Gold, using the CME Bitcoin Indexes (BRR & BRTI) and the CME Ethereum Indexes (ETH_RR_USD) & (ETH_RTI_USD) for reference. 4/8/19 Closing Prices:Bitcoin: $5,212.97 (+$73.70) Ether: $178.22 (+$10.72) Gold: $1,298 (+$9.00) DJIA: 26,341.02 (-83.97) S&P 500: 2,895.77 (+3.03) Nasdaq Comp: 7,953.88 (+15.19) Trading Summary Notes for Monday, 4/8/2019

- It looks like the buying in BITCOIN is still the thing to do. Seems a lot of potential buyers got caught watching and waiting at lower levels and now are missing out (not a good feeling)

- Lets be clear, the lower $3,000 level in BITCOIN was the bottom. The much anticipated “next move up” has begun. Buy the dips

- Following BTC, ETHEREUM is moving up nicely. With our next near term target for BTC at $6,500 expect ETH to see $190-$195

- With more and more investors coming to realize BITCOIN may be a solid “store of value” larger buyers are emerging to diversify their holdings…….including even central banks(?)

- BUT, don’t forget or dismiss GOLD. Centuries of the yellow metal’s acceptance will not disappear

- GOLD dips are a buying opportunity and support around $1,285-$1,290. Upside target still $1,400

- Again, to sum up, near term targets; BITCOIN $6,500 ETH $190-195 GOLD $1,400

- STAY LONG AND STRONG! The bull is back

Current trading positions; LONG BITCOIN, ETH AND GOLD

Bill Taylor is Managing Partner at Fintek Capital & a frequent contributor