By Bill Taylor, Contributor/Fintek Capital We compare the price of Bitcoin, Ethereum, & Gold, using the CME Bitcoin Indexes (BRR & BRTI) and the CME Ethereum Indexes (ETH_RR_USD) & (ETH_RTI_USD) for reference. 2/14/19 Closing Prices:Bitcoin: $3,567.60 (-$1.12) Ether: $121.00 (+$0.71) Gold: $1,312 (+$5.00) DJIA: 25,439.39 (-103.88) S&P 500: 2,745.73 (-7.30) Nasdaq Comp: 7,426.96 (+6.58) Trading Summary Notes for Thursday, 2/14/2019

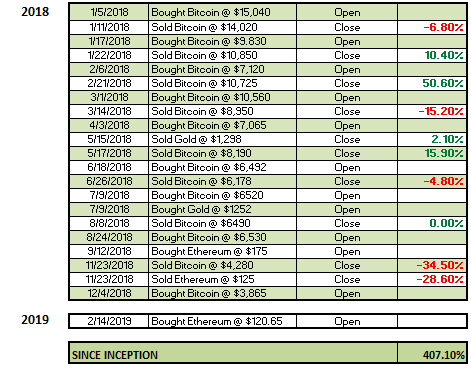

- NEW TRADING POSITION: BOUGHT ETH @ $120.65

- Where has the BITCOIN (crypto) trading gone? Obviously elsewhere, at least for now. In actuality, ALL markets are fairly dull so its not just the crypto sector

- BITCOIN and ETH seem to be “sold out” and waiting for a reason to begin a new move to the upside. Institutional “players” are ready, willing and able to begin aggressively investing, but still waiting for regulatory certainty (hello SEC). If you know when, call me…..please

- In the meantime, being long BTC and ETH would seem an acceptable risk. When a new move begins it will be explosive and very hard to chase. Nobody likes to chase.

- So, lets just say, $3,400 +/- for BTC and $105 +/_ for ETH is VERY attractive long term entry point

- Probably NOT the time to be short cryptos. Upside spikes can be very hazardous to your trading account

- GOLD extremely solid and in a long term new bull run. Nice to see my call for the last several months is working. The $1,200 area WAS the bottom

- Once again, buying the dips in GOLD is the strategy of 2019. Near term target is $1,400

- LONG TERM BULLISH ON BITCOIN, ETH AND GOLD (turned bullish on ETH today)

Current trading positions; LONG BITCOIN, ETH AND GOLD

Bill Taylor is Managing Partner at Fintek Capital & a frequent contributor