By Bill Taylor, Contributor/Fintek Capital We compare the price of Bitcoin, Ethereum, & Gold, using the CME Bitcoin Indexes (BRR & BRTI) and the CME Ethereum Indexes (ETH_RR_USD) & (ETH_RTI_USD) for reference. 2/18/19 Closing Prices:Bitcoin: $3,796.42 (+$223.98) Ether: $142.62(+$17.97) Gold: $1,326 (+$8.00) DJIA: (closed for President’s Day) S&P 500: (closed for President’s Day) Nasdaq Comp: (closed for President’s Day) Trading Summary Notes for Monday, 2/18/2019

- Right on schedule (well, kind of) BITCOIN and ETH decided to not just wake up, but JUMP out of the doldrums bed

- After weeks (seems like years) of both cryptos languishing in the doldrums, the realization that the selling had done itself out

- So, let’s revisit some points of last week’s report;

From last Thursday’s (14th) Taylor Report;

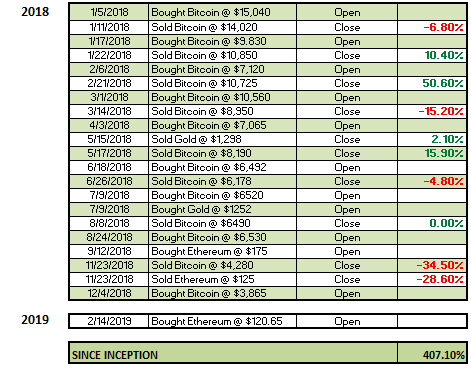

- ESTABLISHED NEW TRADING POSITION: BOUGHT ETH @ $120.65

- BITCOIN and ETH seem to be “sold out” and waiting for a reason to begin a new move to the upside

- Probably NOT the time to be short cryptos. Upside spikes can be very hazardous to your trading account

- When a new move begins it will be explosive and very hard to chase. Nobody likes to chase

- So, lets just say, $3,400 +/- for BTC and $105 +/_ for ETH is VERY attractive long term entry point

So, with BITCOIN and ETH seemingly breaking out, where might these crypto “friends” be headed? GOLD?

- Let’s say BITCOIN needs to get through $4,500 (looks good) then its on to $6,500

- With ETH following BTC, lets expect ETH to travel up to $190-$195

- And GOLD? Once again, buying the dips in GOLD is the strategy of 2019. Near term target is $1,400

- Surprise; LONG TERM BULLISH ON BITCOIN, ETH AND GOLD

Current trading positions; LONG BITCOIN, ETH AND GOLD

Bill Taylor is Managing Partner at Fintek Capital & a frequent contributor