Utilizing the CME Bitcoin and Ethereum Reference Rates

By Bill Taylor, Contributor/Entoro Wealth

We compare the price of Bitcoin, Ethereum, & Gold, using the CME Bitcoin Indexes (BRR & BRTI) and the CME Ethereum Indexes (ETH_RR_USD) & (ETH_RTI_USD) for reference.

6/10/19 Closing Prices:

Bitcoin: $7,957.04 (+$209.76)

Ether: $243.57 (+$6.43)

Gold: $1,328 (-$13.00)

DJIA: 26.062.68 (+78.74)

S&P 500: 2,886.73 (+13.39)

Nasdaq Comp: 7,823.17 (+81.07)

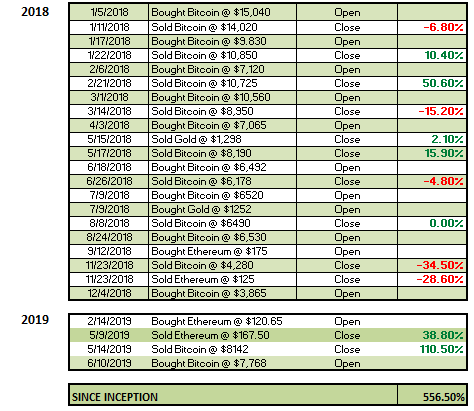

Trading Summary

Notes for Monday, 6/10/2019

- BOUGHT BITCOIN @ $7,768 TO RE-ESTABLISH POSITION

- It appears the backing and filling in BITCOIN has run its course. The $7,500-$8,000 area looks like the “base zone”

- Traders can use $7,500 as a sell stop. Upside movement to $10,000+ looks achievable

- Getting extremely bullish that BTC may test all time highs ($20,000) by year end. GO BTC

- Obviously ETH will go along with BTC strength. Lets say ETH sees $300 on next move

- GOLD has a down day after U.S/Mexico tariff talks moderate. Resistance at $1,350 +/- put up a roadblock…..for now

- China reportedly consistently adding to GOLD reserves. Russia too. And…..AND…..both Russia and China are speaking of dollar alternatives and moving away from the dollar

- Do I sense a possible Russia/China cryptocurrency? Backed by GOLD??? Hmmmm!!

- Near term GOLD price target still $1,400

Current trading positions: LONG BITCOIN AND GOLD

Bill Taylor is Managing Partner at Fintek Capital and a frequent contributor to FintekNews