By: The Sarson Funds Investment Team

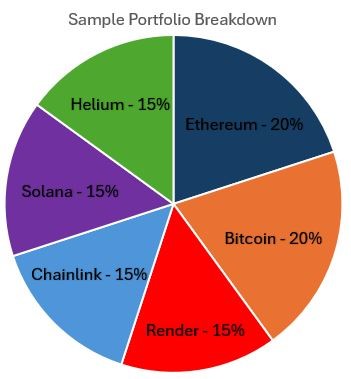

For those diving into cryptocurrency investing, a diversified approach is often recommended. One effective strategy is to construct a balanced portfolio with your allocated funds. $10,000 is a substantial starting point for those looking to diversify existing holdings. Distributed evenly across six prominent cryptocurrencies available on Coinbase, this portfolio holds promise and strength in current market conditions. Coinbase is a popular choice for this endeavor due to its user-friendly interface, robust security features, insurance protections, and suitability for beginners.

Bitcoin (BTC) – The Foundation of Crypto Portfolios

An investment of $2,000 in Bitcoin is considered fundamental in a diversified crypto portfolio. Bitcoin, known as the original cryptocurrency or ‘digital gold,’ has a substantial market cap of $350 billion, making it the most prominent store of value in the crypto market. Bitcoin is considered a large cap, and should be seen as a core holding. Bitcoin’s performance in 2023 resulted in 156.42% growth.

Ethereum (ETH) – The Hub of Decentralization

Allocating $2,000 to Ethereum is a strategic move. As a leading blockchain platform for smart contracts and decentralized applications, Ethereum has a significant market cap of $160 billion and is home to over 3,000 decentralized apps, demonstrating its widespread utility and adoption. Ethereum is considered the core of DeFi and smart contracts, and this exposure is vital to any crypto portfolio. Ethereum’s performance in 2023 resulted in 90.93% growth.

Solana (SOL) – The Fast and Scalable Blockchain

An allocation of $1,500 to Solana is vital to the diversification of a core portfolio. Solana is noted for its speed and low transaction costs, with a focus on user experience and decentralized usage. Hosting many core applications like Solana Pay, Solana is emerging as a strong contender in the commerce sector, boasting a market cap of over $40 billion. Solana is a prime contender in the smart contract sector and should be included in every diversified portfolio. Solana’s performance in 2023 resulted in 920.69% growth.

Chainlink (LINK) – The Industry Standard Oracle Network

An investment of $1,500 in Chainlink complements a well-rounded crypto portfolio. Chainlink served a critical function in the decentralized economy by providing real-world data feeds for smart contracts. Its new aim is to be the standard for cross chain communication and transacting. Their new CCIP (Cross Chain Interoperability Protocol) has initiated the cross chain future that will be needed for consumer adoption of the individual siloed blockchain ecosystems. Chainlink is a core protocol in the future of this industry. Chainlink’s performance in 2023 resulted in 168% growth.

Render Network (RNDR/RENDER) – The Forefront of Digital Rendering

Dedicating $1,500 to Render Network taps into the growing realms of the metaverse, NFTs, digital content creation and AI. Render Network’s decentralized cloud render farm, supported by major VCs and partnerships, positions its RNDR token to benefit from the increasing demand for 3D visual content, GPU computing power, and video rendering. This is reflected in its $1.6 billion market cap. Render is far and wide considered the best in-class when it comes to decentralized rendering and GPU processing. Render network works with various industry leaders in video and image rendering with their technology being used by Netflix, HBO, and Apple to name a few customers of their software. Render’s performance in 2023 resulted in 995.53% growth.

Helium (HNT) – Wireless Networks of the Future

Including $1,500 in Helium’s HNT in the portfolio provides exposure to the burgeoning Internet of Things sector, alongside the largest decentralized 5G network. Helium’s decentralized wireless network, pivotal for IoT devices and phones alike, along with its hotspot mining model and enterprise partnerships, underscores HNT’s potential in a portfolio, given its $1 billion market cap. The growth and revenue of the network has continued to explode despite the HNT token being down significantly from its high. HNT will continue to provide vital decentralized networks, increasing the competitive edge it has, and reducing costs for the end consumers. Helium’s performance in 2023 resulted in 352.53% growth.

If invested with this diversified portfolio on January 1st of 2023, the portfolio balance would have grown over 500% overall to a total of $51,498.25 on December 31st of 2023. This performance is extremely attractive, and the Sarson Funds team believes that these projects will continue to grow their networks and infrastructure throughout 2024. Keep in mind that past performance is not indicative of future results.

This diversified $10,000 investment strategy across various blockchain leaders and innovators can seed a promising future in the digital economy. Each of these projects offers unique value and potential in the blockchain space. This simple portfolio allows you to gain exposure to large cap names which are increasing demands for mainstream and enterprise adoption and mid cap names that are disrupting traditional industries and leaders in their fields. This portfolio serves as a guide for those looking to balance risk and opportunity in the evolving landscape of cryptocurrency.

Disclosures: Not investment advice. The Author, Sarson Funds, Inc. and its affiliated managers hold positions in the projects mentioned.

Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected].

Past performance is not indicative of future results. Not investment advice. Consult your financial advisor to understand if cryptocurrency investing is appropriate for you based on your risk tolerances and investment goals.