By John Sarson, CEO |Sarson Funds, Inc

In recent years, cryptocurrency has transformed from a niche investment into a mainstream asset class. As traditional investors venture into this new territory, understanding where their demand lies becomes crucial. One key area to assess this demand is the premiums on Grayscale grantor trusts, which can offer valuable insights into the market sentiment surrounding individual cryptocurrency projects. But these premiums also carry inherent risks, potentially leading to substantial losses for investors. That’s why we advocate for caution and due diligence when considering these investment options. In this blog post, we will delve into the intricacies of Grayscale grantor trusts, exploring their premiums, potential risks, and why we advise against buying these trusts at a premium.

What are Grayscale Grantor Trusts?

First, let’s break down what Grayscale Grantor Trusts actually are. Grayscale Investments offers unique investment products in the form of cryptocurrency grantor trusts, the most notable being the Grayscale Bitcoin Trust (abbreviated as GBTC and now restructured as an ETF) and the Grayscale Ethereum Trust (ETHE). These investment structures allow you, the investor, to gain exposure to the ups and downs of cryptocurrency without the hassle of owning the actual assets. Instead, Grayscale holds the crypto and issues trust units that you can buy and trade as secondary issues in the OTC market if your brokerage account permits trading in OTC markets.

The Premiums – A Double-Edged Sword

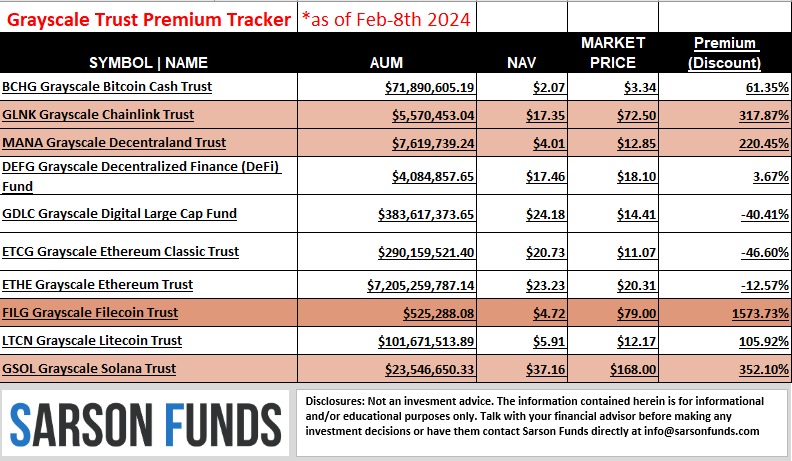

Now, let’s talk about these premiums on Grayscale Grantor Trusts. In simple terms, a premium occurs when the market price of a trust unit is greater than the net asset value (NAV) of the cryptocurrency it represents. This might initially seem like a positive scenario, right? After all, high demand often equates to high returns. However, it’s not that straightforward. While high premiums can indeed indicate a high demand, they can also result in overpriced units. See premium/discount calculations from last week below.

The Risk of Potential Losses

In our opinion, investing in grantor trusts at a premium carries risk, and buying a trust at a significant premium like those shown above, carries significant risk.

If you buy units at a premium and the premium subsequently decreases or vanishes altogether, you’re left with a loss. This decrease could be triggered by several factors, including demand decline, market condition alterations, or a change in Grayscale’s management strategy. For instance, Grayscale has been vocal about their plans to convert these trusts into ETFs (exchange-traded funds). If this happens to their existing offerings trading in the OTC market, the premiums would drop to zero because ETFs, unlike grantor trusts, are “open-ended” investment vehicles designed to trade at or near their NAV.

In light of these risks, we strongly advise doing thorough research and due diligence before investing in Grayscale grantor trusts. It’s also prudent to diversify your portfolio to spread the risk and consult with a qualified financial advisor to make informed decisions based on your risk tolerance and investment goals.

Alternative Investment Options

There are numerous other ways to invest in cryptocurrencies that don’t involve paying inflated prices. Direct ownership of the underlying assets is one such alternative. Others include cryptocurrency ETFs, or, if you are an accredited investor, cryptocurrency private placements such as those offered by Sarson Funds.

As always, we’re here to help you navigate the cryptocurrency investment landscape. We believe in the power of informed decision-making and the importance of strategic foresight. By understanding the mechanics of instruments like Grayscale grantor trusts, you can better position yourself for success in this complex, ever-expanding financial frontier. Always remember, the best investment is one made with knowledge, patience, and a built-in safety net. It may not guarantee success, but it certainly stacks the odds in your favor.

Disclosures: Not investment advice. Talk with your financial advisor before making any investment decisions or have them contact Sarson Funds directly at [email protected]