By Christopher Hamman

Things appeared to have cooled down in the markets with incoming inflation numbers.

The US Treasury waded into the markets with its Cloud report, and PayPal halted its stablecoin project because of regulatory issues with Paxos, its crypto partner.

Finzly started granting sandbox access to FedNow, the Fed’s real-time payment platform, and Fierce, a new kid on the block, is changing how FinTech startups emerge from stealth.

Here’s your week in digital wealth!

WealthTech, RegTech and Treasury

BridgeFT

Cloud-native WealthTech solutions provider BridgeFT introduced WealthTech API, a product that allows FinTech firms, RIAs, and financial institutions to seamlessly deploy analytics, applications, and trade solutions on the go without building infrastructure from scratch.

WealthTech API offers open-ended turnkey solutions without coding from scratch.

US Treasury

According to the recently released Treasury Cloud report, “insufficient information from a CSP can weaken an individual financial institution’s risk management capabilities.” (CSP: Communications Service Providers).

The report also identified challenges surrounding the financial industry’s use of cloud technologies, including human capital and tool gaps when deploying cloud services and insufficient transparency from CSPs to underpin compliance activities by financial institutions.

Bloomberg

Bloomberg revealed its ETF list trading through its Request for Quote service (RFQe), enabling single-click trading for clients.

RFQe is fully integrated with EMSX, the equities execution management system, and allows for transparency and list trading via BOLT, with information leakage minimization.

Crypto, Blockchain and Digital Assets

PayPal

Payments giant PayPal suspended its stablecoin project, citing regulatory issues. This comes as Paxos, a PayPal crypto partner, is facing scrutiny by the New York Department of Financial Services (NYDFS). Paxos is the issuer of the Binance USD (BUSD) and Paxos Dollar (PUSD) stablecoins and a suit by the SEC.

Official Monetary and Financial Institutions Forum (OMFIF)

According to the OMFIF Digital Monetary Institute’s (DMI) annual report, the Distributed Ledger Technology (DLT) industry will have “renewed growth” in 2023.

The report also surveyed central banks with “two-thirds of central bank respondents expect to issue a CBDC in the next 10 years.”

SupraFin

Crypto investment and risk intelligence firm SupraFin launched an institutional-grade risk score and rating product to enable risk analysis and improve investment decisions.

The risk scoring model highlighted the FTX and Terra Luna failures as high risk in case studies.

Fintech, Personal Finance and Apps

Mastercard/Xsolla

Mastercard and gaming commerce firm Xsolla disclosed their partnership to enable payments within gaming ecosystems for players.

Players can use Mastercard’s “Pay with Points” to redeem loyalty points which can be used within gaming ecosystems for commerce and will be deployed alongside Xsolla’s Pay Station with gifting options for friends, family, and loved ones.

Socure/FIDO Alliance

Digital identity firm Socure joined the FIDO (Fast IDentity Online) Alliance, the open standards industry consortium that provides opportunities for identity management for information sharing, cooperation, and integration.

As an alliance sponsor, Socure will cooperate with key players across industries.

Fierce

Former cryptocurrency exchange Gemini’s former CTO Robert Cornish launched Fierce, an app offering the best of everything finance, including an FDIC checking account with an annual percentage yield rate of up to 4.25%, fee-free access to over 55,000 ATMs, fractional stock and ETF trading, a Fully Paid Securities Lending Program alongside 247 support and access to educational finance resources.

Fierce is available for iOS users.

The Android version will be available later on in the year.

Banking, Payments and Infrastructure

Finzly

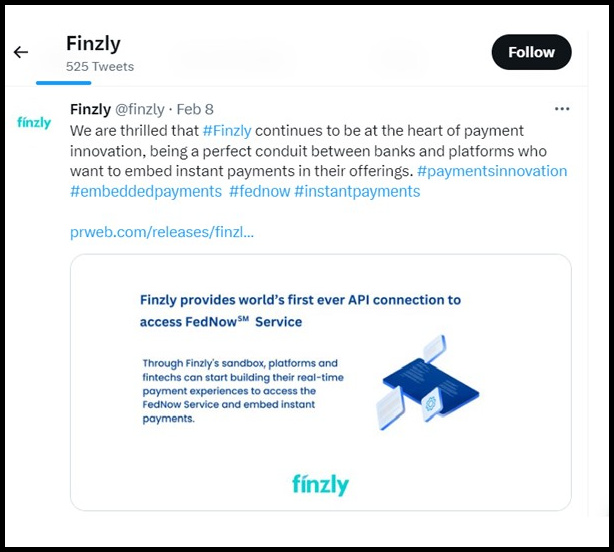

FinTech payments startup Finzly enabled sandbox access to banks, financial institutions, FinTech startups, and personal finance apps to FedNow, the US Federal Reserve’s instant payment platform.

Expected to launch between May and July this year, FedNow allows all kinds of payments to occur, including Swift, Fed ACH, Fedwire, and others.

Commonwealth/JPMorgan Chase

JPMorgan Chase and Commonwealth, the Boston-based nonprofit, extended their partnership into its second phase. Their project, which is focused on underrepresented population segments, creates tools and opportunities to bridge the wealth inequality divide.

The project’s latest focus has been chatbot AI tools, which have seen a significant rise in usage among low and medium-income households.

FTC/MoneyGram

The Federal Trade Commission revealed that over $115 million in refunds were sent to scam victims because of MoneyGram’s inability to crack down on scammers who used the payment system to receive funds.

The FTC and Department of Justice doubled down on previous violations in 2009 and 2012 in 2018 charges.

REtech, Insurtech and Investing

Simply Business/Tarmika/Harborway Insurance™

The small business-focused digital insurer Simply Business partnered with Tarmika, a digital quotes platform for independent agents.

Simply Business will also offer general liability insurance on Tarmika’s platform via Harborway Insurance™.

Orion180/Nearmap

Nearmap, an aerial imaging solutions firm, selected tech-focused insurance carrier Orion180 to improve underwriting processes and risk decisions.

Per the partnership, Orion180 will integrate Nearmap’s AI-powered analytics and imagery via an API for streamlined access.

Tractable/Verisk

Insurance solutions company Verisk collaborated with AI-powered visual assessment firm Tractable to streamline home repairs and insurance claims.

Through Tractable’s AI property solution, policyholders can submit photos and get accurate property damage assessments with Verisk’s Xactimate®.