By Noelle Acheson, Crypto Is Macro Now

With less than a week to go, it’s time to take a quick look at the potential impact of the upcoming Bitcoin halving.

If you’re new to the ecosystem, here’s a quick explainer:

- The security of the Bitcoin network is maintained by “miners” who validate transactions, group them into blocks and compete to add them to the blockchain.

- As a reward for their work, each block contains a number of newly issued BTC. These are put there by the miners themselves when they prepare the blocks, as a “base” transaction (i.e., a transaction with no seller counterparty) into the miner’s address.

- Miners compete to be the first to find the random variable that gives the block a hash within the protocol’s established parameters.

- The successful block joins the blockchain, and those new BTC become valid. (The new BTC assigned in other miners’ blocks are not valid and therefore do not join the BTC supply.)

- To ensure a gradual decline in new BTC issuance toward the hard cap of 21 million, every four years the reward is reduced by 50% – this is known as the “halvening”, or “halving” (I generally prefer the shorter version).

One curious feature is that the halving does not happen at a specific time; rather it is pre-programmed to happen at a certain block height. When block number 840,000 is added to the blockchain, it will have a native reward of 3.125 BTC, rather than the current payout of 6.25.

Since we know that Bitcoin blocks get processed roughly every 10 minutes, we can estimate the date and time, adjusting as we go. This morning, I’m seeing estimates of either April 19 or early on April 20.

Many crypto investors are gleefully anticipating the price run-up that traditionally accompanies and follows halving events.

(chart via TradingView)

Before looking at some historical performance numbers, let’s touch on the accompanying narrative: why should the halving be good for BTC’s price?

The simple reason is because there will be fewer new BTC entering the market, which can mean less sell pressure. Essentially, the rate of production drops, which should boost the price unless demand drops at a corresponding rate.

Many insist that the halving won’t have any effect on the price this time around because the event is known. It’s priced in. Investors have taken positions, and we could see a sell-the-news slump afterwards. (This isn’t new, there are people who say this every cycle.)

This assumes that 1) markets are efficient, and 2) everyone knows about the halving. Both are obviously not true – crypto assets may trade 24/7 and blockchains carry transparent information, but that information is unevenly distributed. Market participants probably know the halving is approaching; but they are only a small subset of total potential investors, and what they don’t know is just how BTC will react since market structure is changing so fast. Crypto investors don’t know what marketing impact halving coverage will have, especially at a time when runaway currency dilution is rapidly becoming a standard. Crypto investors also don’t know what impact the launch of the first spot BTC ETFs in the US will have on demand and flows, nor how much the likely launch of spot ETFs in other jurisdictions might influence demand.

All crypto investors know for sure is the supply side of the halving impact: there will be fewer new BTC entering the market.

So, no, the halving is not “priced in”.

With that established, what has the BTC price done in previous iterations? There are two ways to look at this: the short term and the longer-term.

Here’s a table showing lows and highs around each event:

(table via Axios)

And here’s one that shows the BTC price gains one year before and one year after:

(table via Bloomberg)

So, if patterns hold, it looks like halvings are good for the BTC price, and that we have more upside ahead.

What is not clear is how much – if we get a similar run to the previous cycle, looking at historical performances one year after halvings (the Bloomberg table), BTC could reach $450,000 a year from now, or $270,000 if this cycle turns out to be more like 2016.

Or, if we apply the low-to-high patterns in the Axios table, then BTC could reach $350,000 (using the previous cycle as a guide), or $1.8 million (applying the 2016 cycle performance).

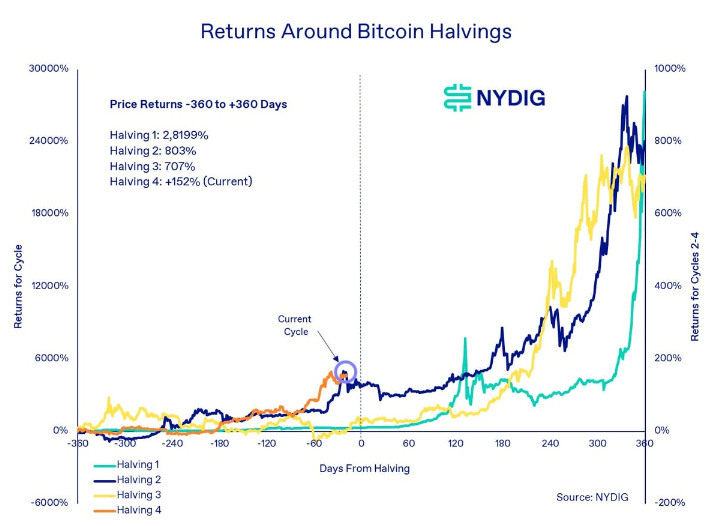

Either way, it seems clear that the bias is to the upside. This chart from NYDIG gives a clear visual of what could lie ahead.

(chart via NYDIG)

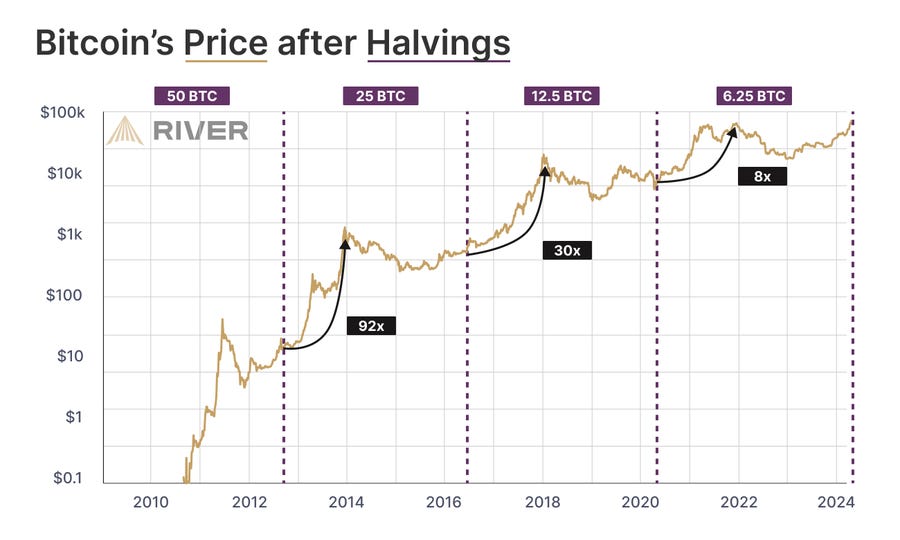

And here’s a different format from River:

(chart via River)

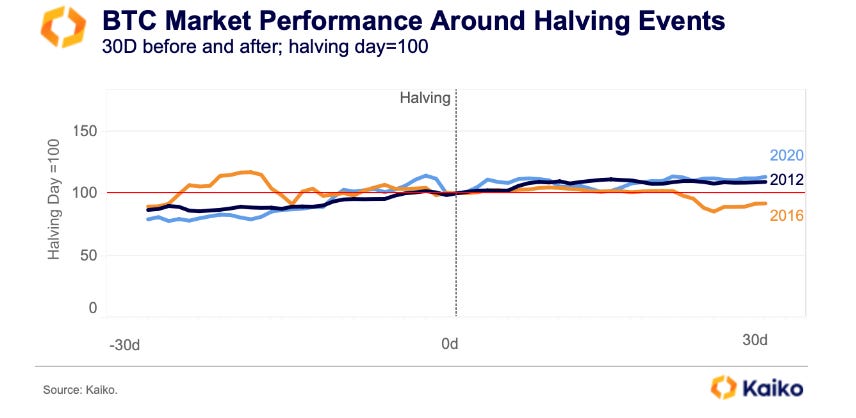

Of course, many investors are concerned with shorter-term performance around big events. Kaiko has plotted a chart of BTC moves 30 days before and 30 days after previous halvings:

(chart via Kaiko)

Short term, the price could go up, or it could go down. No surprise there.

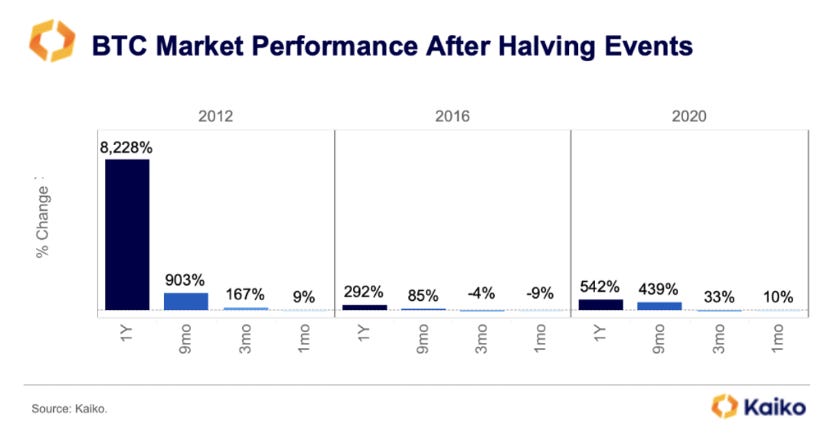

Here’s a useful chart, also from Kaiko, that shows BTC performance at various points after halving events:

(chart via Kaiko)

This cycle is obviously different, for reasons too numerous to go into here. Already, the price movements have broken established patterns: this is the first cycle in which a new all-time high was set just before a halving. In the previous two cycles, the price took 525 and 548 days to reach a new all-time high.

Does that mean the time to the next all-time high will be much shorter than in previous cycles? Could it imply a steeper correction after the event? There’s no way to tell, especially with so many other market drivers at work.

My view is that the halving is a big deal, but more as a reminder of the beauty of the technology and as an opportunity to get more people interested, than as a supply event. I mean, it is – but there is so much else going on that the halving is far from the only narrative.

The halving is about more than BTC supply

Before you scoff and roll your eyes, think about this:

The Bitcoin halving is one of the few events that can happen simultaneously around the world. It has nothing to do with the position of the sun, nothing to do with a physical count of any sort, nothing to do with any offline achievement.

And the Bitcoin halving is also one of the few events uniting communities that happens exclusively online.

There are others, such as protocol upgrades, token airdrops and more – but the timing of those has been decided by a small group of humans. The Bitcoin halving feels more pre-ordained, in that no human has had a hand in it since the original creator(s) of the network left the scene in 2011.

We celebrate the halving in the physical world, at a party, team gathering, or solitary toast in front of our screens. But it is an online-only event, we observe it online, and we perhaps connect with others celebrating on social media, video calls, live transmissions. Online.

An intriguing twist is that the halving doesn’t care about our celebrating – it doesn’t need us, it would happen whether we were watching or not.

But Bitcoin does need us. Bitcoin is meaningless without that online connection between interested parties. Bitcoin is valueless without the network that brings together a global community. The upcoming halving celebrations won’t impact the event at all; but everyone around the world acknowledging the moment are a large part of what gives the network value.

All that is fairly obvious. Interesting, perhaps, but also superficial. Those observations are no more than connected facts. What Allen does is go deeper into what the Bitcoin halving means in terms of space and time, and in so doing, he sketches out part of the invention’s bigger picture impact:

“Factually, the event itself can only be said to exist on the Internet. It was not “in a place”, except insofar as it was in every place. Unlike New Year’s, therefore, it happened for everybody at the same time.Spiritually, the importance of this universality really cannot be overstated. The Bitcoin halving happened at the same time for everybody because the Bitcoin protocol is the same thing for everybody. It knows no borders and no nationalities. It knows no time zones. One might say it is its own reference time. The halving didn’t happen at 8:23 pm GMT — 8:23 pm GMT happened at block 630,000.Similarly, the halving didn’t happen at ~$8,500 BTC:USD, it happened at 1 BTC:BTC.”

Allen is hinting at a new frame of reference, which is a helluva mental leap. We are so used to thinking in terms of the 24-hour clock, but my noon is probably not the same as your noon. We are divided by time zones. Also, we are so used to pricing things in a standard unit of account, universally accepted and understood (everyone knows what a dollar is, even if they don’t use it). We are shackled to a shifting measuring stick.

Will this ever change? For now, that feels ambitious, especially in such a fractured world. But perhaps it is precisely in such a fractured world that alternatives can bubble up. A mind-shift would also be colossally inconvenient, with an insurmountable quantity of capital sunk into the existing system. Yet some ideas have a stubborn way of taking hold and spreading regardless of convenience, bumping into others and shaping dialogues.

It’s easy to dismiss those that insist BTC is “just a speculative asset” as “not getting it”. I’ll argue that very few today “get” what Bitcoin can become long-term. It’s more than a volatile portfolio allocation, sure, but it’s also more than a monetary asset, more than a new technology. It opens a window to a new way of measuring, coordinating and even thinking. Terrifying, but also exciting.

Noelle Acheson is an expert Tradfi & an ecommerce entrepreneur. She was also Managing Director of Research for CoinDesk and Head of Market Insights for Genesis Trading. She has been writing crypto newsletters for 7 years, and wants to continue sharing what she’s learning about crypto, macro and their overlap. https://www.cryptoismacro.com/