By Chloe Howard/Practifi

Wealth management firms are amongst the most process-intensive businesses within the financial services sector. However, many firms struggle to adopt process automation because they lack an understanding of where to begin.

Without the right technology to automate complex processes, firms are left open to operational inefficiencies and overdue tasks. Moreover, the situation becomes more complicated as the business and client list continue to grow.

In order to scale effectively, firms need to systemize what they do and how they do it. Automation ensures that your team consistently delivers the high-quality service your clients expect. Practifi’s enterprise workflow engine comes with ten pre-built workflows to help advisory teams set up complex processes easily and improve operational efficiency within their firm.

The challenges of scaling without workflow automation

When it comes to workflow implementation, the challenge for many large firms is knowing where to start. According to research from Financial Planning Network, advisors feel they don’t have the capacity, resources or expertise needed to systemize their workflows.

Creating a successful workflow requires thoughtfulness to ensure all steps and procedures are in the correct order. However, designing and creating a workflow from the ground up can be an intensive process that requires valuable time.

With Practifi’s suite of ten ready-to-use workflows, you can get a headstart streamlining your firm’s complex processes.

Streamline your complex processes

Automated processes can help transform the way your firm operates, by reducing the time spent on repetitive day-to-day tasks and the need for manual work. In fact, research from Netwealth suggests automation can help improve firm efficiency by 74.1%, and reduce the time spent on administration by 57.7%.

Automating complex or repeated tasks not only saves time but also reduces human error, ultimately delivering a more consistent and streamlined experience for both the client and advisor.

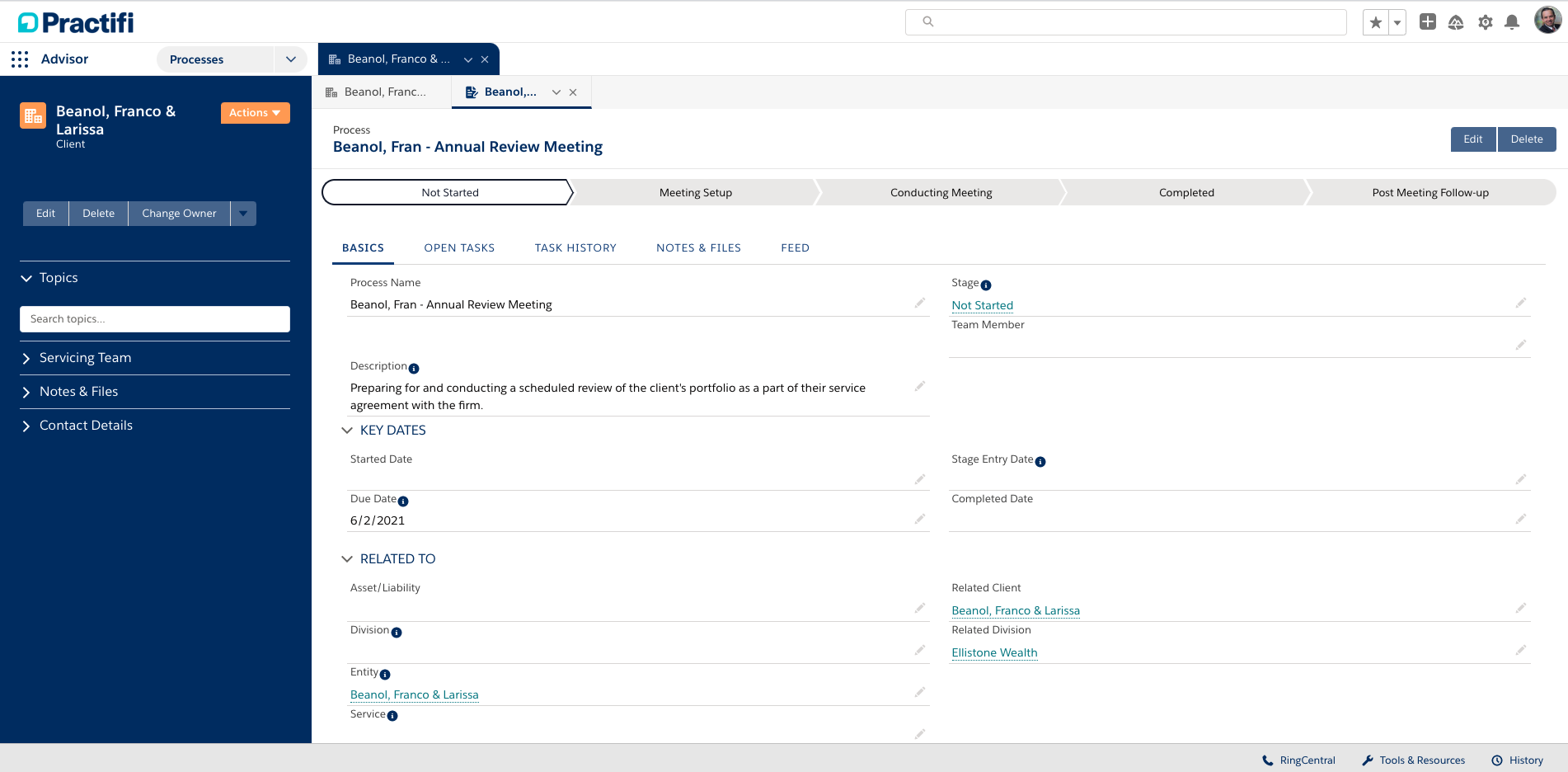

Depending on the process, tasks can vary in complexity and intended outcomes. Practifi’s pre-built workflows can be used for simple, day-to-day processes like the initial contact with prospects, or for more complex tasks like conducting an annual review meeting.

If we take the annual review as an example, advisors can immediately access a dashboard overview with all the basic client information, key dates and active processes. Each process has its own established stages and assigned staff who are responsible for each task – making it easy to add new team members or reassign tasks as needed.

Every step in the process is automatically documented, stored and repeated for each client, ensuring consistency in the delivery of service. This allows teams to easily track processes as they’re running, helping improve collaboration and accountability.

Whether it’s opening a new account, setting up an annual review, preparing for discovery meetings or finalizing a financial plan, Practifi’s ready-to-use workflows can help firms get started in streamlining their complex processes.

Interested in learning more?

With so many day-to-day processes involved in running a successful advice firm, the need for automation is critical. Align teams, reduce costs and enhance the client experience, all the while improving your firm’s operational efficiencies with Pracifi’s pre-built workflows.

If you’re interested in learning how to make the most of our pre-built workflows, your Client Success Manager will be happy to help. And, if you’re interested in learning more about how Practifi can benefit your firm, reach out to a member of our team today.

Get the latest insights delivered straight to you inbox.

To learn more about Practifi, visit www.practifi.com.