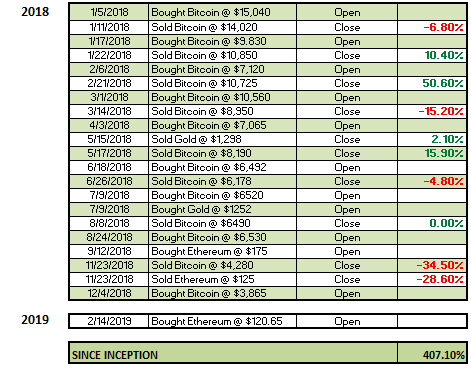

By Bill Taylor, Contributor/Fintek Capital We compare the price of Bitcoin, Ethereum, & Gold, using the CME Bitcoin Indexes (BRR & BRTI) and the CME Ethereum Indexes (ETH_RR_USD) & (ETH_RTI_USD) for reference. 3/4/19 Closing Prices:Bitcoin: $3,708.00 (-$85.75) Ether: $125.65 (-$5.59) Gold: $1,286 (-$10.00) DJIA: 25,819.65 (-206.67) S&P 500: 2,792.81 (-10.88) Nasdaq Comp: 7,577.57 (-17.79) Trading Summary Notes for Monday, 3/4/2019

- “Good news” sank BITCOIN, ETH and GOLD. A potential trade deal with China and the U.S. coupled with comments that inflation “is not, or will not, be a problem” put pressure on cryptos and gold

- Additionally, President Trump speaking out against the U.S. Federal Reserve and its policies caused investors to sell “riskier” assets (BTC, ETH, GOLD)

- Will the selling last? Oh, not for long. There are way to many problems floating around the globe to ignore

- BITCOIN, after the run up to over $4,000, is experiencing a normal pull back. Taking the stand that BITCOIN has bottomed and turned, the next “big” number is $4,500. Expect that number to be tested

- ETH is just following in BTC’s footsteps. If BITCOIN gets to our next target of $6,500, ETH should see $190-$195

- GOLD, after a big run up is pulling back…..sharper than I expected…..but still the long term up trend is intact

- Near term target for GOLD is $1,400. Buy the dips

- Way to0 much going on (positive) in the digital asset/crypto sector to dent the potential upside in BITCOIN, etc. GOLD, gotta have it

- LONG TERM BULLISH ON BITCOIN, ETH AND GOLD

Current trading positions; LONG BITCOIN, ETH AND GOLD

Bill Taylor is Managing Partner at Fintek Capital & a frequent contributor