By Bill Taylor, Contributor/Fintek Capital We compare the price of Bitcoin, Ethereum, & Gold, using the CME Bitcoin Indexes (BRR & BRTI) and the CME Ethereum Indexes (ETH_RR_USD) & (ETH_RTI_USD) for reference. 3/7/19 Closing Prices:Bitcoin: $3,871.44 (+$25.70) Ether: $136.89 (-$.24) Gold: $1,286 (+$1.00) DJIA: 25,473.23 (-200.23) S&P 500: 2,748.93 (-22.52) Nasdaq Comp: 7,421.46 (-84.46) Trading Summary Notes for Monday, 3/7/2019

- The cryptos (BTC and ETH) and GOLD seem to have found some solid footing after a short pullback

- To put numbers on it; BITCOIN firm at $3,800+/-, ETH $130+/- and GOLD $1,280+/-

- If (when) BITCOIN pushes through $3,900 (tomorrow/weekend?) a run to the $4,500 resistance level should be next. A break through of $4,500 should take BTC to $6,500

- ETH is just following in BTC’s footsteps. When BTC gets to resistance at $4,500 ETH should be $150. If BITCOIN gets to our next target of $6,500, ETH should see $190-$195

- Hmmmmm! GOLD pulled back on dollar rally and easing China/US trade differences. BUT, strong dollar today didn’t hurt Gold. that’s positive

- GOLD’S long term up trend is intact. Near term target for GOLD is $1,400. Buy the dips

- Way too much going on (positive) in the digital asset/crypto sector to dent the potential upside in BITCOIN, etc. GOLD, gotta have it

- LONG TERM BULLISH ON BITCOIN, ETH AND GOLD

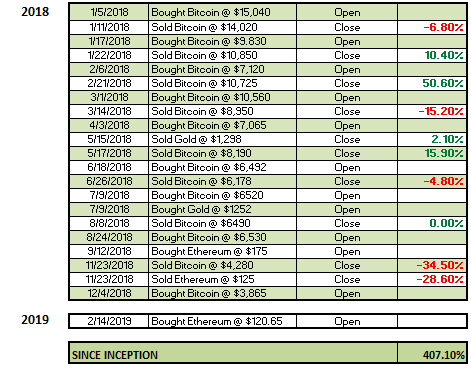

Current trading positions; LONG BITCOIN, ETH AND GOLD

Bill Taylor is Managing Partner at Fintek Capital & a frequent contributor