By Christopher Hamman

Happy new month!

As we all heave a sigh of relief with the end of the debt ceiling drama in the US and no recent shifts in monetary policy, things look at least somewhat more settled for a sunny summer. Many may certainly disagree with that analysis, though, as there are still many hurdles ahead for US monetary policy.

In the meantime, J.P. Morgan Asset Management integrated its trading platform with the Clearwater Analytics suite.

Congress might classify most digital assets as commodities (that is possible), and consumers face risks from uninsured money apps.

Plus, the real estate industry has officially entered the digital payments space.

This is your week in digital wealth!

WealthTech, RegTech and Treasury

J.P. Morgan Asset Management Inc./Clearwater Analytics

Financial professionals now have the best of both worlds, with the integration of the J.P Morgan Asset Management ” MORGAN MONEY® global trading platform ” and investment and data management tools from Clearwater.

Per the cooperation, permissioned users will access solutions from both parties via a single interface.

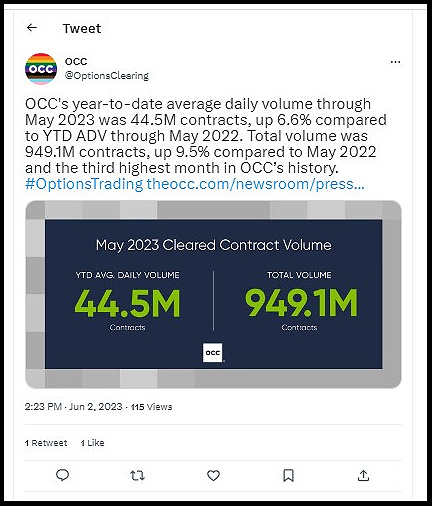

The Options Clearing Corporation (OCC)

The largest global derivatives clearing organization, OCC, hit a high year-to-date average daily volume of 44.5 million contracts last month, a six percent rise from the same period for the third time in its history.

The total volume hit 949.1 million contracts, up 9.5% for the same period.

Tru Independence Asset Management LLC.

Wealth management consulting solutions firm Tru Independence addressed the volatility and rise in innovation within the financial services industry with “truview”, a new “Experience As a Service (EAS)” platform.

Portfolio services, client management and integration, risk analysis, market behavior, and data integration are all part of the truview ecosystem.

Crypto, Blockchain, and Digital Assets

The Commodity Futures Trading Commission (CFTC)

The CFTC Division of Clearing and Risk (DCR) issued an advisory on the inclusion of digital assets in Derivatives Clearing Organization(al) (DCO) platforms.

The advisory warned that increased digital asset activities come with heightened risks and that it will apply compliance measures for each expansion application.

Capitol Hill

Draft legislation from the Republican-led U.S. House of Representatives could tilt digital asset classification in favor of commodities rather than securities.

The draft bill is a culmination of efforts led by House Agriculture Committee Chair Glenn Thompson (R-Pa.) and House Financial Services Committee Chair Patrick McHenry (R-N.C.).

In related news, the House Agriculture Committee will hold a “The Future of Digital Assets: Providing Clarity for Digital Asset Spot Markets.” hearing on June 6th, 2023.

Uniswap

There was a bit of drama within the decentralized finance DeFi space, with the majority of votes within the Uniswap community favoring “no fee” changes (45%-42%).

Some wallets that favored the no-fee change had a limited transaction history.

Uniswap is the largest decentralized exchange (Dex)in the world.

FinTech, Personal Finance, and Apps

Consumer Financial Protection Bureau (CFPB)

With more Americans leaning on payment Apps to conduct their day-to-day transactions, the CFPB highlighted the risks of primary dependence on these financial platforms due to their non-FDIC insurance status and strongly advised consumers regarding their use cases.

Banks, credit unions, and traditional finance institutions offer deposit protection, but FinTech deposit and liability insurance is nonexistent (mostly).

Aliaswire/PayVus

Small and medium businesses (SMBs) received a lifeline with the introduction of “PayVus”, an all-in-one ecosystem that does almost everything finance and management but with reduced costs and increased efficiency.

PayVus allows merchants to issue, process, and manage credit cards from a single interface.

Socure

Identity management for the fastest-growing financial consumer population segment in America (Gen Z) reached new levels with a new milestone from boutique KYC solutions provider Socure.

The Nevada-based firm indicated its solution could identify almost three-fourths of new Gen Z financial product applicants far ahead of rivals in the industry.

Banking, Payments, and Infrastructure

Alkami Technology Inc./upSWOT

Cloud banking solutions provider, Alkami upped its game with the extension of its partnership with business intelligence and analytics solutions provider upSWOT.

This will enable actionable and precise insights and customer behavioral benchmarks to bank clients from within Alkami’s ecosystem.

Bankjoy

It seems there are new flexibilities in the banking software space with upgrades in “Business Banking 2.0”, a boutique digital banking solution for banks and credit unions by Bankjoy, a financial solutions firm.

The shift towards flexible digital services provides just about everything business and corporate customers need for their needs.

Apple/Goldman Sachs

Apple’s “neo banking” partnership with Goldman reportedly hit some snags with high-volume transfers from clients experiencing “delays”.

Per media reports, new savings accounts within Apple’s ecosystem triggered security alerts and the delays usually got resolved within several days.

“Apple Card” owners can create a high-yield savings account with backend services offered by Goldman.

REtech, Insurtech and Investing

Empathy/Majesco

A new partnership between Majesco, an insurance solutions provider, and Empathy, a boutique life insurance support solutions firm, can help cushion the financial and emotional impact of the death of loved ones on families.

Majesco will handle the digital end of things, while the human services will get covered by Empathy.

Cross River Bank/Payments.io

The real estate industry now has purely digital payment options with the revelation of a partnership between Cross River Bank, a financial infrastructure provider, and Payments.io, a “Software-as-a-Service” platform geared toward the sector.

The Cross River Application programming interface (API) and the Payment.io ecosystem integration will give players flexibility and options, including ACH and wire transfers.

Atidot

InsurTech solutions firm Atidot launched its AI platform as part of a push to revolutionize the insurance industry.

Apart from policyholder behavioral predictions, the platform offers dynamic features, including API integrations for marketing campaigns, customer relationship management (CRM) tools, product suggestions, selections, onboarding, and more.