By Christopher Hamman

Ahh, the smell of spring…and everything that comes with it!

The US economy overheats from time to time, (that’s normal, though this time feels different), and the Fed responded with a rate hike.

The White House overtly displayed its stance toward digital assets, which has shifted toward negative territory with hostile comments in the “Economic Report of the President.”

CME’s Micro futures hit a new milestone, and the software teams at Goldman Sachs now generate code with AI tools.

The construction industry got a big boost with Procore launching an insurance product.

Here’s the week in digital wealth!

WealthTech, RegTech and Treasury

CME Group

The CME Group-owned and operated Micro E-mini Equity Index futures exceeded 2 billion contracts across the big four indices-The Dow Jones Industrial Average (DJIA), NASDAQ 100, S&P 500, and the Russell 2000. With 2.73 million in average daily trading volumes year-to-date, and 20% trading volumes outside market hours, the three-year-old E-Mini has proven to be a resilience and liquidity indicator with hedging and scaling options that match market activity.

Praxent

FinTech solutions development firm Praxent disclosed the launch of its Accelerator App, which speeds up and improves value chain processes for WealthTech firms market-wise.

The Accelerator App comes with “off-the-shelf” features that allow for improved vertical integrations, including APEX-powered custodian tools, account opening and compliance, and rapid robo-advisor development functionality alongside an investor dashboard.

Ascent Technologies Inc.

Chicago-based RegTech solutions firm Ascent Technologies Inc. unveiled its Compliance Confidence Scorecard solution that improves corporate readiness in several areas, including regulatory response strategies, product and service flexibility, change management, and compliance updates.

The scorecard also aids organizations to remain in step with legal changes that could occur on the go.

Crypto, Blockchain and Digital Assets

The White House

President Joe Biden’s administration has continued to dig in its heels per its anti-crypto stance with the release of the “Economic Report of the President ” authored by the White House Council of Economic Advisers.

The thirty-five-page chapter on digital assets continuously slammed the asset class and its underlying technologies. The report asserted that many tokens are without underlying economic values and that crypto assets “have brought none of these benefits”, a reference to the revolutionary benefits digital assets offer wallet holders.

NASDAQ

In response to growing demand and interest from institutional investors, stock exchange operator NASDAQ Inc revealed plans to launch crypto custody services at the end of this year’s second quarter.

NASDAQ has already applied to the New York Department of Financial Services (NYDFS) to obtain a charter for a limited-purpose trust company that will operate the custody service.

ARK Invest/Coinbase

Cathie Wood’s ARK Invest continued its investment drive with a $17.88 million Coinbase stock purchase via its ARKK Innovation and ARKW Next Generation Internet ETFs.

The purchase followed a first-time sale of 160,887 of Coinbase shares worth $13.5 million.

FinTech, Personal Finance, and App

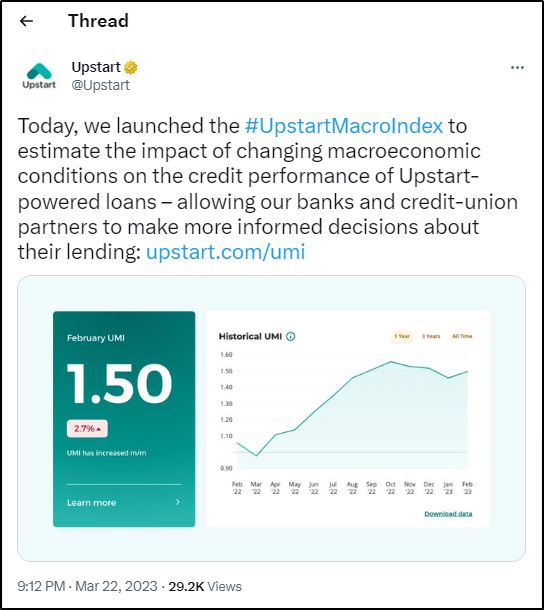

Upstart

AI credit marketplace platform Upstart launched the “Upstart Macro Index”, a monthly publication that measures how changing macroeconomic conditions, including personal savings rate, inflation, and unemployment, affect loans.

The index will draw its insights from the platform’s AI loan-month model.

Cross River Bank/Pay.com

Cross River Bank revealed the extension of its continuing partnership across the pond with Pay.com, a United Kingdom-based payment solutions platform.

Per the partnership, Cross River Bank will enable Pay.com to expand its offerings to the US and international markets via the Cross River API, which will power credit and debit card processing, ACH payments, and more.

Fiserv/Central Payments LLC

Banking-as-a-Service (BaaS) firm Central Payments LLC and Fiserv, a leading global financial solutions giant, disclosed their partnership which combines Fiserv’s payment processing ecosystem and Central Payments’ award-winning Open*CP Fintech API Marketplace® to enable FinTech firms and other financial institutions to create robust solutions.

The cooperation enables seamless product development and increases go-to-market timelines while increasing operational efficiency

Banking, Payments and Infrastructure

JP Morgan

As part of efforts to improve the ease of payments, banking behemoth JP Morgan will reportedly launch a pilot biometric payment solution that includes facial and palm authentication.

The pilot program will include physical stores across America and has Formula 1 Crypto.com Miami Grand Prix as a potential participant.

A 2024 rollout for merchants is possible if the pilot program succeeds.

Goldman Sachs

Software engineers at Goldman Sachs are reportedly working with regenerative artificial intelligence (AI) tools to generate code automatically.

The project is still at the concept stage and sandbox level for now, but that could change quickly as generative AI tools (ChatGPT anyone?) are disrupting workplaces.

Eastnets/Microsoft

Global payment and compliance solutions provider Eastnets disclosed the migration of its Swift bureau infrastructure and sanctions solutions for the Americas to Microsoft’s Azure cloud service.

Financial institutions can now access infrastructure via public cloud solutions, paving the way for increased flexibility and scalability for the 300-plus banks and financial institutions that are a part of Eastnets’ client base.

REtech, Insurtech and Investing

Simply Business/AmSuisse

Digital insurance firm Simply Business revealed it will offer commercial insurance solutions with Texas-based AmSuisse.

Per the partnership, AmSuisse, a boutique wholesale insurance solutions provider, will offer Simply Business’s small business-focused solutions to agents.

Procore Technologies

Construction management software provider Procore Technologies unveiled Procore Risk Advisors, a construction insurance brokerage offering that offers insurance programs in partnership with leading providers Swiss Re and Allianz Global Corporate & Specialty.

“Procore Risk Advisors” integrates directly with the Procore construction software management ecosystem and anchors off data to improve its customer offerings.