By Bill Taylor, Contributor/Fintek Capital We compare the price of Bitcoin, Ethereum, & Gold, using the CME Bitcoin Indexes (BRR & BRTI) and the CME Ethereum Indexes (ETH_RR_USD) & (ETH_RTI_USD) for reference. 4/22/19 Closing Prices:Bitcoin: $5,310.69 (+$44.38) Ether: $171.28 (+$2.78) Gold: $1,275 (+$3.00) DJIA: 26,511.05 (-48.49) S&P 500: 2,907.97 (+2.94) Nasdaq Comp: 8,015.27 (+17.20)Trading Summary Notes for Monday, 4/22/2019

- BITCOIN’S slow but solid rally continues with ETH being dragged along. A good solid weekend and more steady buying is pushing BTC ever closer to the mid-$5,000 level

- Volatility is rather muted but there is good professional buying creeping back into the crypto sector

- More and more large institutions are beginning to allocate funds to the digital asset sector. Firms like Andreessen Horwitz, BlackRock, etc are actually changing their business models to be able to invest in BITCOIN, ETH, etc

- Global regulators (France, Switzerland, etc) are readily adapting friendly regulations to allow more institutions to invest in BTC, ETH, etc. Expect more to follow

- Expect volatility to begin to increase as the price of BTC climbs. I always recommend trailing stops (-10%?) to protect gains

- Near term targets for BITCOIN still $6,500 and ETH $195

- GOLD, having broken through support at $1,285-$1,290, seems weak with buyers stepping back for now (they moving to crypto?) May see $1,250-$1,255

- Long term target for GOLD still $1,400

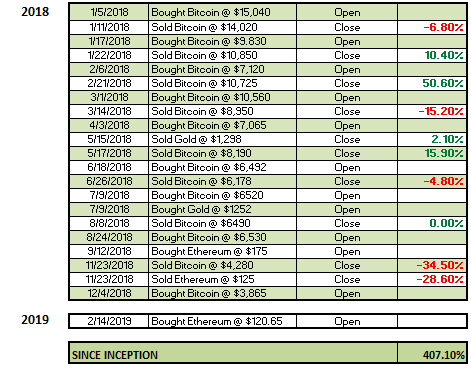

Current trading positions; LONG BITCOIN, ETH AND GOLD

Bill Taylor is Managing Partner at Fintek Capital & a frequent contributor