By Bill Taylor, Contributor/Fintek Capital We compare the price of Bitcoin, Ethereum, & Gold, using the CME Bitcoin Indexes (BRR & BRTI) and the CME Ethereum Indexes (ETH_RR_USD) & (ETH_RTI_USD) for reference. 5/6/19 Closing Prices:Bitcoin: $5,649.44 (-$64.75) Ether: $164.87 (+$3.64) Gold: $1,280 (+$1.00) DJIA: 26,438.48 (-66.47) S&P 500: 2,932.47 (-13.17) Nasdaq Comp: 8,123.29 (-40.71) Trading Summary Notes for Monday, 5/6/2019

- BITCOIN eases off on after weekend profit taking. Late trad has BTC moving up again and getting ready for an assault on $6,000

- The “real” congestion/resistance area is $6,400-$6,500. Look for $6k to not be a big deal but make lots of headlines.

- ETH seems to have pick up some buyers. Its trading higher in late trade and looking at moving toward $200

- News that Fidelity is only weeks away from offering BITCOIN trading to institutions obviously adding strength. More big firms will be following Fidelity

- Should/when BITCOIN pierces $6,000 might be a good time to lighten up a bit. Its been a nice move so far

- GOLD firmed up and seems to be finding some buyers down around the $1,260 area. U.S. sending a carrier battle group to the Persian Gulf helped GOLD

- The “action” (or lack of) in GOLD is very similar to the price movement in BITCOIN earlier this year. Don’t be left watching when GOLD explodes up

- Way to many geopolitical risks/events that are being overlooked will also make GOLD explode (?)…..but again, when

- Summing up; BITCOIN near term target $6,500 ETH $190-$195 GOLD $1,400

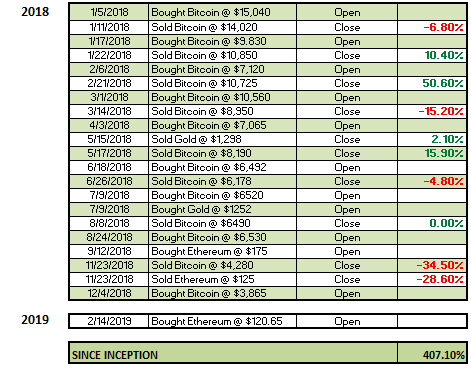

Current trading positions; LONG BITCOIN, ETH AND GOLD

Bill Taylor is Managing Partner at Fintek Capital &