By Joe Mrak, CEO, Foundation Source

High-net-worth investors are increasingly interested in charitable giving, but many wealth management firms and practitioners are not dedicating a proportionate amount of time to understanding their clients’ motivations and considering the implications on their financial plans. In fact, seven out of 10 wealthy investors identify themselves as philanthropic, yet most are not receiving formal guidance on how to effectively pursue their charitable goals.

This gap presents a great area of opportunity for financial advisors, but they need suitable tools and resources to seamlessly incorporate charitable planning into their practice. PhilTech – software developed to facilitate giving – has enormous potential to make charitable planning a more practical, cost-efficient offering for HNW clients.

Here are four ways that PhilTech can help elevate a wealth management practice.

- Delivering Better Outcomes Across Investing, Tax and Estate Planning

Bringing philanthropy under the wealth management umbrella enables advisors to expand and deepen their client relationships, while ensuring that investment strategies, tax plans and wealth transfer priorities are all aligned and carefully coordinated. PhilTech can give advisors a consolidated view of their clients’ philanthropic activity that they may not have had access to before. This information can be fed into existing dashboards and tools to enrich client profiles and support more informed planning and decision-making across the practice.

- Increasing Bandwidth for High-Value Client Interactions

We often hear advisors lament the administrative requirements associated with charitable giving. These tasks can be cumbersome and unexciting, and they eat up time that could be spent working with clients on topics that require a more personalized, human touch. Advisors can leverage PhilTech to automate tasks like opening an account in a donor-advised fund, submitting grants and processing grant payments, tracking the annual payout requirement for private foundations, reviewing grant applications from nonprofits and charities, managing charitable expenses, and producing standardized reports. Leaning on technology for more back-office work will clear the runway for advisors to spend more time with clients on strategic planning to execute their philanthropic missions.

- Supporting Family Collaboration

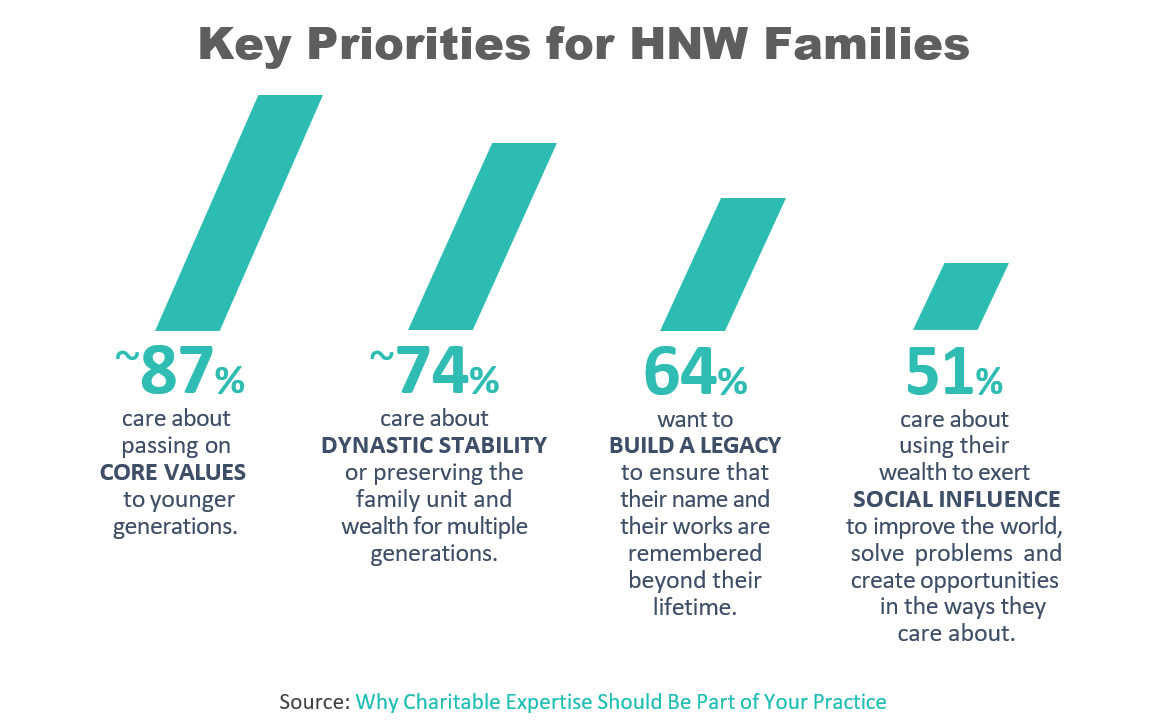

Building a family legacy is a common motivator for HNW clients to pursue philanthropy – 87% of wealth clients are looking for ways to pass on core values to the next generation. But navigating interpersonal dynamics and bringing relatives together to collaborate effectively can be a challenge. PhilTech can relieve some of those pressures and minimize unnecessary roadblocks that families may face in their philanthropic pursuits. For example, conflicting schedules and lifestyles can make it difficult to bring family members together to clarify their values, formalize their mission and decide how to deploy their charitable assets. A cloud-based PhilTech solution can make it possible for families to connect from any location to review the same materials and vote on grants and applications, while advisors can stay informed and manage financial implications in real time.

- Preparing the NextGen for Leadership

As the next generation prepares to inherit a vast amount of wealth, technology is a key tool to threading the needle between the older and younger generations of a family to solidify their legacy. For example, mobile applications tend to be an effective channel to engage NextGen in their roles and responsibilities, and can offer a window into their interests, values, and preferences. Our research with Millennials and Gen Z finds that learning from family members and having a passion for a specific cause or issue are the top drivers behind their charitable activities. Advisors can encourage Boomer and Gen X clients to focus on their commonalities with younger family members and leverage PhilTech to involve them in creating and tracking charitable plans to support the causes that everyone is passionate about.

High-quality technology combined with deep human expertise has long been recognized as the foundation for successful wealth planning from an investing perspective. The time is now for the wealth management industry to recognize the opportunity for this model to help address the philanthropic aspect of clients’ portfolios. PhilTech reduces the friction associated with incorporating philanthropic capabilities into an advisor’s practice while reaping the benefits of deepening client relationships and building trust and loyalty with HNW families for years to come.

Joseph (Joe) Mrak is CEO of Foundation Source where he is responsible for the vision, strategy and growth, as it becomes the leader in cloud-based SaaS charitable giving solutions. A well-known pioneer in SaaS-based financial technology, Mr. Mrak’s numerous innovations have helped transform the delivery of holistic wealth management services to high-net-worth individuals and families. Previously, Mr. Mrak held leadership positions at Refinitiv, a leader in financial markets data and infrastructure, Solovis, an institutional investment management platform servicing family offices, endowments, RIAs and insurance firms, and FolioDynamix, an integrated wealth management platform he founded in 2007 that is now part of Envestnet.