Alternatives investment platform iCapital has recently announced a new acquisition and several new offices & senior hires.

Founded in 2013 by CEO Lawrence Calcano, the firm now boasts 288 employees, 81 external white label platforms, $65B+ in platform assets ($8B of which is from outside the US) and over 500 funds listed, with over 4,500 total members.

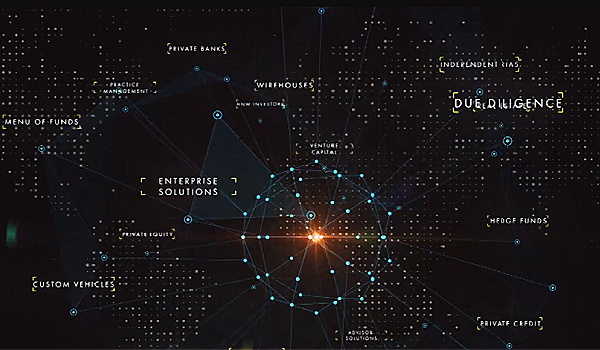

According to the announcement, “The firm’s flagship platform offers advisors and their clients access to a curated menu of private equity, private credit, hedge funds, and other alternative investments at lower minimums with a full suite of due diligence, administrative support and reporting in a secure digital environment.”

This week, the firm has announced it is acquiring a Portuguese-based fintech RunTimei Group, Ltd. with a team of 65. Once the deal closes later this year, Lisbon will become the firn’s international hub for technology operations and development.

Additionally, the firm has added two senior hires – Marco Bizzozero out of Zurich and Tonm Slocock out of London – to advance the firm’s European footprint – and added new offices in ZUrch, London and Singapore.

Lawrence Calcano, Chairman and CEO of iCapital Network, has stated “iCapital’s latest international investments demonstrate our commitment to bringing the opportunities of private investments to international advisors and investors and fulfilling our mission of powering the global alternative investing ecosystem. As appetite for private market investing continues to grow, our expanding team will deliver these strategies – powered by a robust technical infrastructure – to advisors and their clients across the globe.”

The firm also enjoys an elite group of international investors. Ping An Global Voyager Fund out of Hong Kong led iCapital’s most recent $146M USD round with additional investors BlackRock, Blackstone, Goldman Sachs, Affiliated Managers Group, Hamilton Lane, WestCap, UBS, BNY Mellon and Wells Fargo. Existing strategic investors in iCapital from prior funding rounds include The Carlyle Group, Credit Suisse, JPMorgan Chase & Co, and Morgan Stanley Investment Management.

According to the firm’s website, “iCapital provides integrated alternative investments support to advisors and their qualified clients in collaboration with the following firms, which include an extensive list of fund administrators (UMB, SS&C, State Street, etc.), custodians (Schwab, Fidelity, TDA, etc.), tranfer agents and audit/tax firms.

iCapital has long been a firm we have watched. Their ongoing growth demonstrates keen interest from the investment community in their model, and their internal expansion signals an ongoing foreign appetite for compliantly presented alternatives investments out of the US. As always, one to watch.