By Nathan Frankovitz | Sarson Funds, Inc.

Recently, the crypto asset market cap fell from a peak of $2.502 trillion to as low as $1.351 trillion in the wake of growing high-profile concern over Bitcoin’s energy usage. Though climate change is a legitimate problem facing humanity, we remain confident in crypto’s net positive impact on global environments as explained here.

Of course, no amount of research will change the fact that Bitcoin’s price, along with the rest of the crypto asset market, was heavily impacted by the fear catalyzed by Elon’s tweet. Look no further than the Crypto Fear & Greed Index, which set its lowest low in over a year on April 16th, to confirm the significance of this wave of amplified skepticism. As humans, we are inevitably subject to the visceral responses these sudden changes in market sentiment and the volatile values of our portfolios can bring. However, we are reminded of the adage “when in doubt, zoom out”. Bitcoin is still the best performing asset of the last decade. Fundamentally, its value proposition to society remains unchanged.

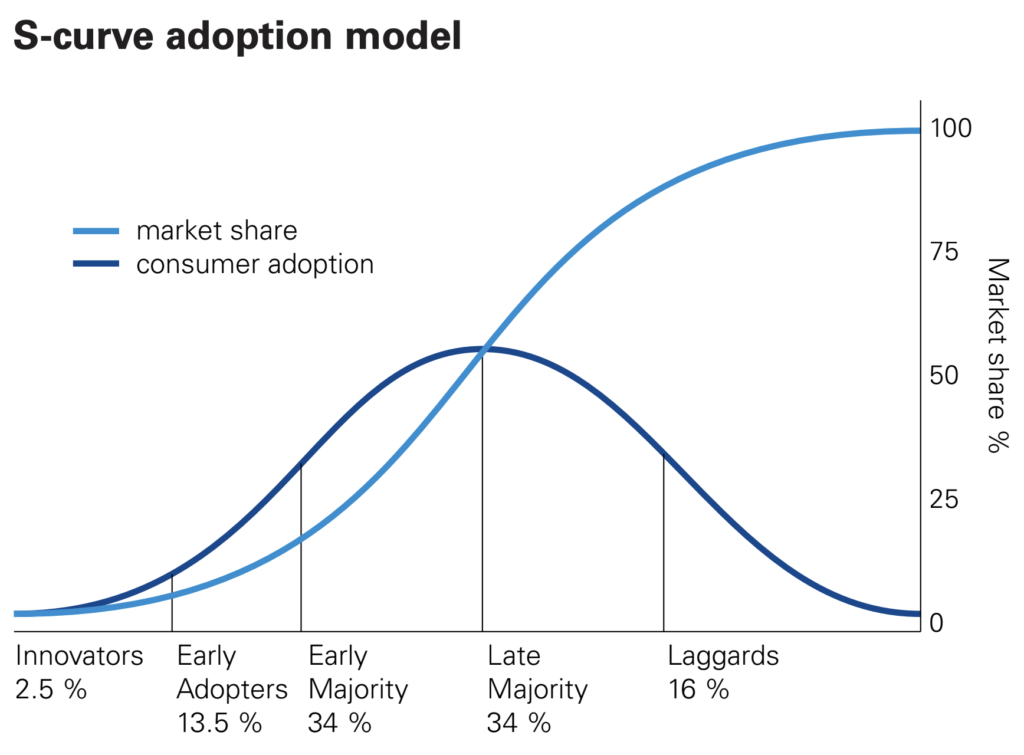

Gemini’s “The State of U.S. Crypto Report 2021” is telling. According to their survey, Gemini estimates 14% of U.S. adults now hold cryptocurrency. Other studies estimate the number to be even higher. This marks a crucial transition along the crypto adoption curve. As history has shown, the percentage of customers that adopt an innovation over time can be split into 5 distinct categories across the risk tolerance spectrum: innovators (2.5%), early adopters (13.5%), early majority (34%), late majority (34%), and laggards (16%). Accordingly, crypto asset adoption is nearing the end of the early adopter phase as it tests entry into the early majority phase. Importantly to investors, this is where market cap growth begins to accelerate along the s-curve.

As we watch to confirm this transition, it is important to understand what distinguishes innovators, early adopters, and the early majority. Describing innovators, Icon Ventures Europe’s Michael Mullany writes, “…because they’re always enthusiastic about their latest Hot New Thing discovery, the Majority of the world tends to tune them out.” He continues, “The Early Adopters are where markets are made or broken. Early Adopters are the respected gatekeepers for new Innovations.” In contrast, “If Innovators care about what’s NEW and Early Adopters care about PROVEN VALUE, then the Early Majority cares about what’s POPULAR.”

Prior to 2017’s ICO mania, Bitcoin and most other crypto assets’ narratives largely purported to be stores of value and peer-to-peer electronic cash (cryptocurrencies). Without widespread adoption, however, these networks were essentially proof-of-concept in comparison to their endgame visions for a decentralized monetary future. We can think of crypto asset users in this phase as the innovators.

In 2017, smart contracts built on the Ethereum network began to show promising development. Utility tokens for protocols like Compound, MakerDAO, and Bancor appreciated sharply as crypto assets gained traction on a new use case: decentralized finance, or “DeFi”. Filled with exuberance by the potential for crypto assets to supplant multi trillion dollar industries, investors threw a collective $4.6 billion at 430 ICOs (initial coin offerings) worldwide. For most of these projects, expectations were never realized. Though the bear market of 2018 was bleak on paper, early adopters paved the way for today’s market by monitoring progress and backing the most fundamentally sound crypto projects.

As Gemini’s study suggested the imminence of 15% U.S. crypto market penetration toward the end of 2020, it reasons that the 16.0% threshold marking the transition from “early adopters” to “early majority” is taking place in the bull market of 2021. Unprecedented institutional adoption, fundamentally void speculative mania, and a host of new financial on-ramps all exemplify key characteristics of early majority technological adoption as explained by Mullany: “They’re influenced by customer marketing: they care deeply about references and they trust Early Adopters to gate-keep new products. They often skip the detailed, show-me-the-value proof of concepts and trials that Early Adopters require.”

Once adoption reaches critical mass as the early majority enters, total percent adoption tends to accelerate. KPMG’s “Consumer Adoption: How to predict the tipping point” substantiates this idea, illustrated by the S-curve adoption model. Despite being the most dangerous four words in finance, we are open to the idea that in this crypto bull cycle, “this time is different.”

Source: KPMG

Dubbed the “Supercycle”, this theory suggests that mass inflow of retail investment will “break convention”. We believe this theory pairs well with the “Lengthening Cycle Theory”, popularized by prominent crypto analyst and founder of Into The Cryptoverse. Broadly, this theory suggests that Bitcoin’s market cycles are lengthening while producing diminishing returns. Unbelievable as it may seem today, this implies Bitcoin’s volatility will approach zero in 10-15 years. For Bitcoin to remain pursuant to both the supercycle and lengthening cycle theories, it must undergo even more massive adoption before stabilizing at the top of its theoretical S-curve.

Of course, digital assets are extraordinarily competitive and difficult to predict. Even among crypto enthusiasts, there are many who hope that Bitcoin’s narrative for perfect scarcity will be overtaken by assets like Ether. Only time will tell. What do you think will happen? Please drop a like, follow, share, or reach out to us. Crypto is all about community.